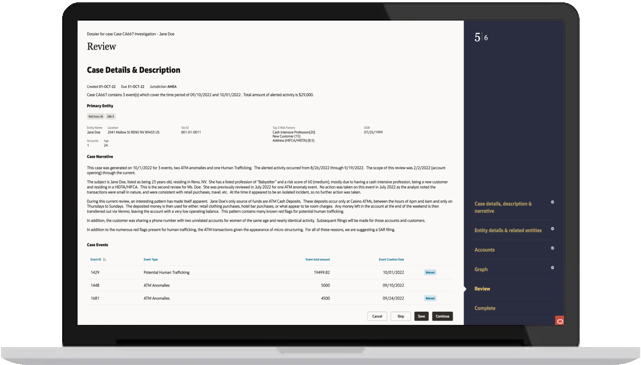

Effective alert management is crucial, but the strategy behind it is even more critical

By harnessing cutting-edge Generative AI and Machine Learning innovations, we empower compliance leaders to implement tailored and directed controls that align with their specific anti financial crime and compliance definitions.

Oracle Financial Crime and Compliance Management (FCCM) enhances your team's efficiency in guarding against the most sophisticated financial crimes, including with tools to help address ever-evolving regulatory and compliance guidelines.