Trust

Secure and compliant data management, underwriting, and auditing will help meet regulatory commitments, minimize reputational risk, and support the customer journey and lifecycle.

by Chris Skinner

I am delighted to be invited to write the foreword for this report. For years, I have talked about how banks have the advantage—the data advantage. Banks have the customer data. They can win if they leverage that data correctly, with permissions.

Unfortunately, most incumbent banks have ignored this advantage. They have allowed a lot of customer data to disappear or be ignored. In contrast, most digital banks are focused on using lifestyle financial data to deliver services geared for their customers' lifestyle needs. Traditional banks should have been doing this, but in most cases, they could not because their systems were too fragmented, siloed, and unstructured to achieve it.

The imperative today is to consolidate, rationalize and organize data for more than just risk and fraud requirements. Data today needs to be used for customer intelligent marketing and service. Then the question has to be: what is customer intelligent marketing and service?

It's a tough question as it demands that banks use data, with permission, to provide predictive, proactive service without being creepy. Predictive, proactive service is all about analyzing data and transactions, and seeing trends and correlations that the customer maybe does not see.

My favorite example is the bank that noticed I purchase a subway ticket on most days. Over the period of a few months, they could see that I spend thousands on subway tickets and would save a lot if I started using season tickets. But why haven't I got a season ticket? Because I never have enough disposable income to afford one. So this particular bank then offers me a season ticket. They tell me that I can save hundreds with a season ticket—and all I need is to swipe to get one. Guess what? Now I've got the season ticket, and I love the bank.

Having said that, what's really happening here is that the bank is using our transactional data to analyze our financial lifestyle. It is not offering me a season ticket out of some charitable enterprise, but to have me take a loan to buy one. I get the season ticket and save; the bank funds the season ticket and makes money on the loan.

It's a win-win for both.

The thing is that most banks don't think this way. Most banks aren't smart with data. They keep data in silos, fragmented across the organization with no single view of the customer. This is where most banks fail.

The future is one where data will differentiate. Data is the oxygen of the organization. It's not oil or any other form of limited resources. It is a mountain of knowledge that needs to be organized, rationalized, sorted, and consolidated so that the financial firm has more knowledge of the customer and their needs than anyone else.

In fact, it intrigues me that most banks fear or are fans of Ecommerce giants. Banks should be following them. What they do best is use customer data to create not just sales, but also relationships. They know that you like ABC and that others who like ABC, also like XYZ. So, they promote XYZ to you. It is not intrusive. It is beneficial.

This is the true nature of data leverage. When a bank has a holistic view of the customer's digital financial life, makes offers and advice based on that life, and does this with permission and acceptance – a critical point as, otherwise, it could be creepy – then you get a win-win situation.

This report from Oracle studies that win-win relationship in-depth and the five trends identified:

These are critical lessons to learn for the next decade of frantic and cut-throat competition.

I trust you will enjoy this report and look forward to engaging in further dialogue over the next few years regarding competition, innovation, and service based upon data insights and data leverage.

In conclusion: if you are not fit or ready to provide customer intelligent marketing and service through data insights, what are you fit for?

Chris Skinner is known as one of the most influential people in technology, and as an independent commentator on fintech through his blog, the Finanser.com. His latest book (sixteenth!) is called Doing Digital, and shares the lessons of doing digital transformation learned through interviews with BBVA, China Merchants Bank, DBS, ING and JPMorgan Chase. He chairs the Financial Services Club and Nordic Future Innovation, is a non-executive director of 11:FS and on the advisory boards of various firms including Mode, Moven and Meniga. Mr. Skinner has been an advisor to the United Nations, the White House, the World Bank and the World Economic Forum, and is a visiting lecturer with Cambridge University as well as a TEDx speaker.

The criticality and force of data is underpinning an evolution in the global banking landscape. In the diverse, growing major economies, data has proven to be a major challenge—but also a massive opportunity for banks that can create a Data Advantage.

Banking models and services are being broken apart, made simpler, and streamlined – but not always by the big incumbent banks. The pandemic has accelerated digital adoption, and consequently, fintechs and major platform tech players have demonstrated that they can leverage technology and data to enable services and reduce costs to deliver financial services in more agile, accessible, and user-friendly ways.

To remain competitive, banks will need to collect and converge all their data from multiple sources into a single database, then cleaning, monitoring, visualizing, analyzing, and interpreting the data to transform it into intelligence.

This report lays out 5 key trends that will impact the financial services industry, touching on customer experience, the rise of digital banks, open banking, and operating costs and risks. Following which, this report covers how banks can create a true Data Advantage and tap into the data economy by adopting a data-first approach centered on the customer. A selection of real-world case studies is also provided to showcase how financial institutions like ICICI Bank, Westpac and BBVA have leveraged data to transform their business and operations.

In the data-led future, the winners will be those with the most robust model for data management and control. At Oracle, we help organizations leverage the power of data to overhaul their back office, transform their front office, and deliver amazing customer experiences.

The banking industry is in a state of flux. Over the past year, banks have had to undergo rapid digital transformation for business continuity as consumers were compelled to adopt digital banking. As the world now recovers, digital banking has become integral to the mainstream consumer – and banks will need to shift their digitization focus from ensuring survival to enhancing service.

The customers of today are both more demanding in their service expectations and less loyal about who they use to meet their financial servicing needs—more so given the dramatic rise of digital banks and how easy it is has become to switch providers.

Adapting to these rapidly changing customer expectations means more than just fancy digital access channels. Banks need to build a digital core to develop relevant services by collaborating with the ecosystem, all while grappling with increasingly stringent regulatory requirements and security breaches that make it challenging to respond with agility.

The face of banking is evolving, and time is fast running out as competition intensifies. To help you move forward with greater certainty, here are five key trends that will shape the financial services landscape and our take on how best to respond to each trend.

As a result of the pandemic accelerating digital adoption, even non-digital native customers have embraced the convenience of digital banking. And with an increasingly open and collaborative ecosystem coming into place, customers – even loyal ones – may switch if another bank offers a superior digital customer experience.

of financial services customers are satisfied with their customer experience.1

of customers have bailed on transactions because of CX friction1.

With over half of customers wanting financial institutions to provide proactive financial advice2, targeting consumers by major life milestones is no longer sufficient. Banks need to listen harder and learn much more about what customers want and need, in order to create the right product and offer it in an appropriate way as the customers move through life at their own pace.

To achieve this, banks must incorporate a plethora of customer-centric capabilities to harness customer experience moments, build greater customer loyalty, and plot the digital customer journey to attract and retain customers.

This means investing in technology that can help create meaningful services and enrich the consumer's daily life through a continuous process of evolution and modernization of the services stack.

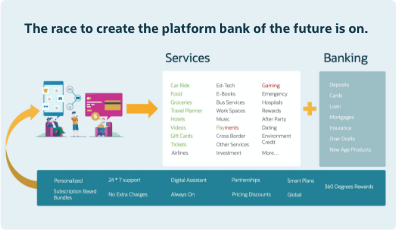

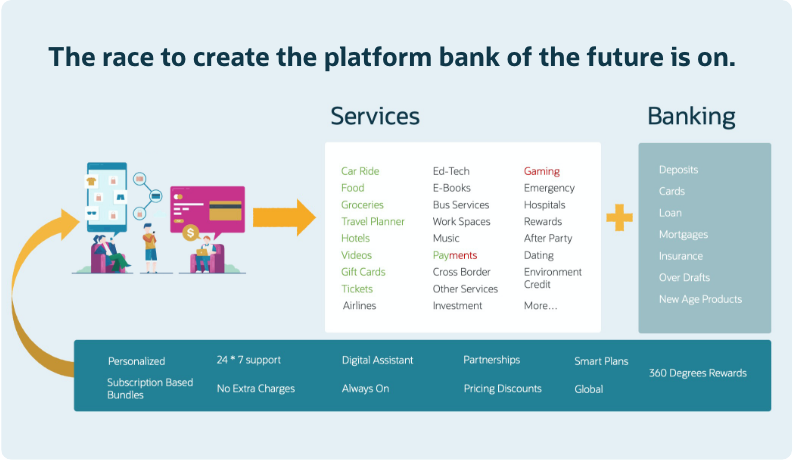

Competition is heating up. Incumbent banks are being challenged by nimbler digital banks, which in turn are facing ferocious competition from non-banking brands & big techs such as Apple, Google, Carro, Grab and FWD entering the space. Additionally, the rise of digital banking platforms has also made it easier than ever for consumers to switch providers.

of banking consumers are willing to switch to banking solutions offered by Big Techs if/when they are brought to market2.

of banking consumers are very likely to use an alternative payment method in the next 12 months2.

digital banks were established between 2016 to 2020, bringing the total to 1033.

The surge in competition means banks need to leapfrog competitors through differentiation, using deep customer insights and intelligence to power end-to-end-CX innovation while working in concert with a rich financial services analytics layer that delivers pervasive and consistent business intelligence.

Incumbent banks will likely need to migrate to a new platform for agility and versatility, and digital banks will need to strengthen their back office, increase security, and mitigate risks with the right platform.

Banks will have to continue to invest in technology to enable new services, reduce costs, and focus on connecting all the data in faster, agile environments.

Open Banking initiatives have transformed the financial services industry into an ecosystem, with incumbent banks extending their core offerings through adjacent value propositions, accessing new markets via alternative distribution channels, and launching entirely new ventures. Strategic partnerships are now the norm, where financial institutions share banking data to address considerations and capture opportunities.

of banks report that

they have a clear strategy for developing open APIs4.

of banks see open banking more as an opportunity than as a threat4.

The shift in banking consumer demographics and their social and behavioral differences will drive demand for new business models. Open banking unlocks new monetization opportunities by enabling banks to extend their distribution to 3rd parties and create innovative banking and non-banking products. These new capabilities require a cloud-based platform with open APIs that can integrate and comply with the rapidly growing industry ecosystem.

To overcome the challenges of building and migrating to a new ecosystem while ensuring compliance with cloud security and regulations, banks should look to re-platform on an agile, cost-effective infrastructure that's based on industry standards and take advantage of proven digital products and services in the market.

With millions of transactions to process daily, every cent saved in cost per transaction can lead to giant leaps in profit and competitiveness. Technologically advanced digital banks have taken this to a whole new level, addressing increasingly large amounts of data and sophisticated use cases without exponentially raising operational costs—and incumbent banks need to follow suit or risk falling behind.

Average annual cost of running an account for WeBank5.

Average annual cost of running an account for incumbent banks5.

In this evolving business environment of anytime-anywhere utility pricing and continually changing customer expectations, banks must lean on cloud-native applications to gain the cost advantage.

Through machine learning, routine processing and infrastructure management work can be intelligently automated, drastically reducing both manpower cost and human errors.

Additionally, a cloud native infrastructure will also enable faster and less costly development and deployment of new services and features to cater for evolving customer demands.

For banks, fending off escalating cyberattacks and responding to the growing burden of data privacy and an uncertain regulatory environment is more than just about security and compliance. A privacy or security breach also means losing precious brand reputation and goodwill, which can be extremely difficult to rebuild.

Average number of loss events suffered by each surveyed bank in 20196

Average gross loss of an operational risk event6

To ensure data security and regulatory compliance while maintaining agility, banks need a reliable and trustworthy digital core that can:

Instead of attempting to build or piece together all these capabilities, banks should seek an infrastructure and cloud partner with proven expertise and solutions in these domains.

An experienced technology partner will enable the bank to leverage analytical data for informed, risk-aware decision-making that enhances regulatory and business reporting while also being well-positioned to scale data needs flexibly.

In the new digital normal, a bank's ability to thrive hinges on its ability to gain mastery over its data. The deluge of data from newly-digitized systems and services is a double-edged sword—if not managed and utilized well, the sheer volume, variety, and velocity of data generated by financial transactions can quickly strain and overwhelm business systems, increasing management and compliance complexities that, in turn, can dramatically affect profitability.

of customers adopted online banking since the start of the pandemic7.

of execs state that customer data problems lead to broken customer journeys1

increase in financial crime compliance costs in 2020 compared to 20198.

However, when used strategically, data can be a valuable source of actionable insights to improve customer experiences and internal processes and reduce risk.

of the S&P 500's market value is intangible assets9, but…

of organizations know the value of their data10.

The forces impacting the banking industry are all driven—and can be met by—data. Banks need a data-first approach centered on the customer. They need a single complete data-driven platform to help them accelerate business automation, innovation and experience.

They need the Data Advantage.

Data is the currency of the digital business landscape. For banks, the Data Advantage means better and easier monetization, increased efficiency, and reduced costs. It means the ability to deliver personalized experiences and engagements to create greater value for both the banks and their customers. It means gaining these unique strengths:

Trust

Secure and compliant data management, underwriting, and auditing will help meet regulatory commitments, minimize reputational risk, and support the customer journey and lifecycle.

Responsiveness

Rapidly generate insights from real-time data to spin up new capabilities and evolve your supply or value chain, at scale and in line with growing customer sophistication and expectation.

Simplification

Support customers with optimized and value-driven experiences through unified processes that are interconnected at every level.

Competitiveness

Gain a competitive edge against both incumbent and digital banks with a 360-degree view of your customers, CRM, sales, and acquisitions.

To grasp this Data Advantage, banks need to learn to leverage data as a form of capital to develop superior services and improve business processes—and that means transforming into a data-driven business.

Data-driven businesses require a unified focus on skills, back-end processes, core IT infrastructure and enterprise data architecture to achieve data liquidity, productivity, and security, built on a foundation of data governance. Only with these data characteristics in place can a bank truly unlock its data capital.

Getting data from its point of origin to its many points of use efficiently to reduce the time, cost, and effort of repurposing data.

Optimizing the incremental revenue generated and costs avoided by applying data to decisions and actions.

Providing protection for both the observer and the observed over observations about them.

Built on a foundation of data governance

The datafication of nearly every activity in personal, commercial, and civic life has rewritten the social contract between people, companies, and governments. As a result, keeping data secure means not just authorization, access, encryption, and auditing, but also transparency and upholding data property rights declared in a patchwork of overlapping regulations worldwide.

Achieving these characteristics in a cost-effective, highly-efficient manner requires a strategic transformation partner that understands the technical requirements and has the necessary capabilities—a partner like Oracle.

When you're embedding a digital core into your bank, you need a partner that has mastered data, understands financial services, and whose solutions give you the flexibility to deploy precisely to your needs.

Helping financial institutions succeed on our platforms

Digital and incumbent banks chose Oracle

Countries with banks powered by Oracle

Successful digital bank transformations

Mutually monetizable relationships with fintech and digital banking innovators.

Accelerated ecosystem maturation with accelerated productization and monetization of fintech innovation.

Faster time to innovation which in turn, provides more value to banks and insurers.

Oracle's integrated tech stack seamlessly join the dots between your front office and back office to streamline operations and deliver superior customer experiences, powered by a cloud native infrastructure.

The cloud provides banks with a multitude of unique benefits: the latest data management innovations, advancements in performance, high availability, reliability and single access across existing relational data and unstructured data from social, mobile, and IOT technologies. Additionally, moving to the cloud represents an opportunity to shift resources from maintenance to innovation.

However, Oracle understands that everyone's journey to the cloud is different. While the cloud provides undeniable benefits by reducing IT spend, accelerating innovation and increasing agility to support business transformation, data governance and residency requirements may prevent full adoption of the cloud – that's why even today, 2/3 of enterprise workloads remain on-premises.

With Oracle, it doesn't need to be one or the other. We are the only technology player to have our complete portfolio of public cloud services, including Autonomous Database and Oracle Fusion SaaS applications, available on-premises in your data center as Dedicated Region Cloud@Customer.

This means you get to choose which cloud services to run on-premises and which in the public cloud, giving you the cloud experience and benefits while retaining control of your data in a single, converged database.

Choose from on-premises, public cloud, or a combination of both without sacrificing data governance.

Achieve architectural and operational identicality across deployment options to simplify management and movement of data and applications.

Gain the cloud experience and benefits while retaining control of their data to meet data governance and residency regulations.

Oracle has a 42-year heritage in data management and databases—in fact, the majority of the planet's data resides in Oracle databases.

As a technology partner whose mission is to help people see data in new ways, discover insights and unlock endless possibilities, Oracle has the unique insights and capability to deliver the Data Advantage, because we understand data better than anyone else.

We're the information company with the most complete stack and data capability in the world.

We use open design and interoperability to ensure enterprise data can talk across your business all the time.

We have the biggest investment in data and data automation-related innovations in the world.

We handle the largest data sets globally, at a scale of over 10bn transactions a day.

We are continually driving improvements based on the feedback from our large base of enterprise customers.

We have security at the CPU level to protect and accelerate your data power.

We have the only true autonomous data capability to provide you with AI + Automation at speed.

Oracle has played a vital role in helping incumbent and digital banks around the world transform their operations.

BBVA increased conversion rates by 30-40% with marketing campaigns generated through Oracle Machine Learning.

Learn More

Allied Bank reduced its cost per transaction from $3-4 to just 40 cents with Oracle Banking Digital Experience.

Learn More

Radius Bank saves millions in customers deposits and increases its Net Promoter Score by 20% with Oracle CX Service.

Learn More

ICICI Bank created an enterprise-wide view of risk to address increasing regulatory requirements and provide a risk-adjusted Performance view for investors using Oracle Financial Services Analytical Applications.

Learn More

Westpac rationalized 23 systems and created a single Customer Service Hub to gain a single view of customers across all Westpac brands and products with Oracle Banking Platform.

AsiaPay scaled beyond 40m transactions a year, and gained the ability to deliver personalized services and distinguish trade risks in real time with Oracle Autonomous Data Warehouse.

Learn More